Your retirement should be something to look forward to. It is one of the most important lifestyle changes anyone experiences. Ensuring security in later life needs careful planning. A pension is a tax efficient way of providing an income and potentially a lump sum for your retirement. 25% of the pension fund can be taken as a tax-free cash lump sum and the balance can also be taken. This will be taxed at the tax payer’s marginal rate.

Pensions can be complicated; they are intended to be a long term way of saving for security in retirement. 2014 saw extensive changes in the regulations surrounding pensions and you may not be aware of what these changes are for the implications for your savings. There are a range of pension solutions available to suit a variety of needs, getting it wrong can be expensive and result in a much lower return in retirement. HMRC put limits on the level of contributions you can make: HMRC Annual Allowance Limit. This link will give you the information you require.

• Self-invested personal pensions (SIPPs)

A self-invested personal pension (SIPP) is a pension ‘wrapper’ that holds investments until you retire and start to draw a retirement income. It is a type of personal pension and works in a similar way to a standard personal pension. The main difference is that with a SIPP, you have more flexibility with the investments you can choose.

• How it works

With standard personal pension schemes, your investments are managed for you within the pooled fund you have chosen. SIPPs are a form of personal pension that give you the freedom to choose and manage your own investments. Another option is to pay an authorised investment manager to make the decisions for you. SIPPs aren’t for everyone. More information is available on The Pensions Advisory Service site which refers you to https://www.moneyadviceservice.org.uk/en/articles/self-invested-personal-pensions.

• We use LV, James Hay and Suffolk Life to provide this service.

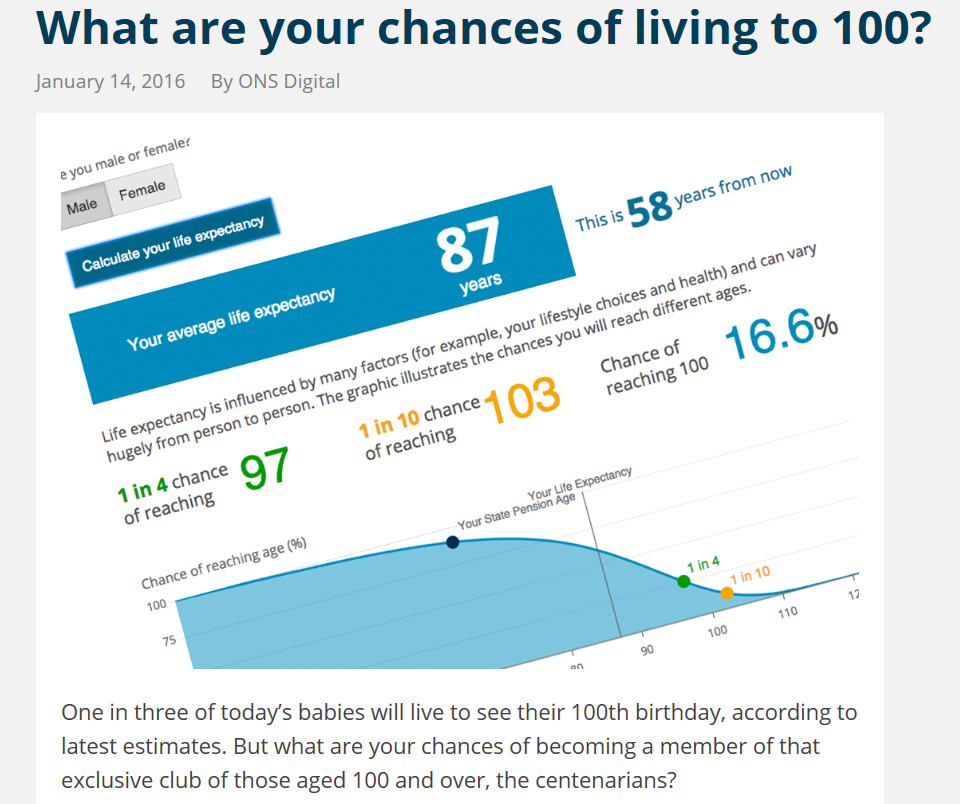

Here you calculate your life expectancy

People in their 20s are now expected to live well into their 80s or 90s – so it’s worth bearing in mind that if you retire at 65, you will probably have 20 years or more of needing an income. If you are facing retirement soon, it’s essential that you seek advice to ensure you are managing your finances as efficiently as possible. For instance, it may be beneficial to consolidate the collection of pensions you have accumulated over your career to get a better annuity rate. If you’re planning for your retirement, you may wish to consider the following pension plan options:

Tax free cash

25% of the fund(s) can normally be taken as a tax free cash lump sum. **

Annuity (secured pension)**

An annuity is a plan which provides, in exchange for a lump sum, an income for life. If you decide to buy an annuity you must decide on which basis. The options include: –

Level

Payments are fixed at the outset, and continue at this level until death

Single life or joint life

Provision may be included for a spouse’s pension

Escalating

Payments increase each year at a fixed rate, or a rate which which changes in line with changes in the Retail Prices Index

Unitised

Payments are linked to the performance of an investment fund or funds, so may go up or down

Enhanced

People with medical conditions which might reduce their life expectancy, such as diabetes or high blood pressure, may receive a higher income

Income Drawdown

Your pension funds remain invested with income drawdown, but you take an income from the fund. This provides flexibility as you can vary your income to meet your requirements. However, as your funds are still invested, you are still exposed to the risk of your investments going down in value.

State pension

The basic state pension is payable from State Pensionable age and is currently £113.10 a week for a single person and £180.90 for a couple (2014-15 income tax year). If you do not have enough contributions your state pension will be less. In addition you may be entitled to a State Second Pension.

From 2017 a flat rate state pension is likely to commence in 2017. The weekly payment when it was proposed in 2013 was £144. 35 years of National Insurance contributions are required.

**The above is a brief outline on the options available to you on retirement. With effect from Spring 2015 pensions regulations change and there is no longer the requirement to purchase an annuity from your retirement savings. The restriction of 25% limit for tax free cash will be removed and the whole fund can be taken if required. This has tax implications. All funds less the tax free cash will be added to your income for that year and taxed at the marginal rate.

Having spent the majority of your working life saving for retirement and having accumulated your pension savings pot it is important that you understand the advantages and disadvantages of the options available to you, and we recommend you seek professional advice.